So instead of doing inputdata <- structure.

The excel filename is used as the name for the imported dataset in the dataframe. Ive been to other similar threads and the only workable code I could find was. We can calculate the autocorrelation for every lag in the time series by using the acf () function from the tseries library: The autocorrelation at lag 0 is 1. The first sum in the formula is the value of X T SX when there is no autocorrelation (i.e. I had imported my data from excel, containing 64 rows and 15 columns, into R in order to calculate the autocorrelation using the acf().

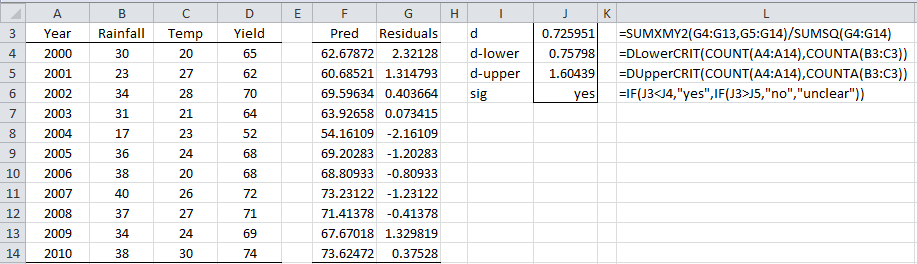

where X i is the i th row in the design matrix X. When there is autocorrelation with lags up to h > 0, we use the following value. We will first download live data in excel from the Sharekhan Trade Tiger terminal and later we will apply a formula for the intraday trading system on the. Y = a + b 1 X 1 + b 2 X 2 + b 3 X 3 +. The standard errors that result are called Heteroskedasticity and Autocorrelation Corrected (HAC) standard errors. \begingroup The two methods for calculating confidence bands are. Then apply the cor() function to estimate the lag-1. Each partial autocorrelation could be obtained as a series of regressions of the form. First, create two vectors, xt0 and xt1, each with length n-1, such that the rows correspond to (xt, xt-1) pairs. In general, we can manually create these pairs of observations. (beta coefficient) is the slope of the explanatory The lag-1 autocorrelation of x can be estimated as the sample correlation of these (xt, xt-1) pairs. The explanatory (independent) variable(s) you are When mean values are subtracted from signals before computing an autocorrelation function, the resulting function is usually called an auto-covariance function. To emphasize that we have measured values over time, we use " t" as a subscript rather than the usual " i," i.e., \(y_t\) means \(y\) measured in time period \(t\).Īn autoregressive model is when a value from a time series is regressed on previous values from that same time series.The dependent variable you are trying to predict Within Excel, we can use the CORREL function to. As an example, we might have y a measure of global temperature, with measurements observed each year. We can use the following formula to calculate the autocorrelation at lag k 2. Autocorrelation calculates the correlation between each lag of N against the original non lag data observations. Let us first consider the problem in which we have a y-variable measured as a time series. How to Calculate Stocks Autocorrelation in Excel Step 1: Calculate the Variance The variance of the series can be calculated using the VAR formula as follows: \VAR. Usually, the measurements are made at evenly spaced times - for example, monthly or yearly.

A time series is a sequence of measurements of the same variable(s) made over time.

0 kommentar(er)

0 kommentar(er)